Trading Watchlist:

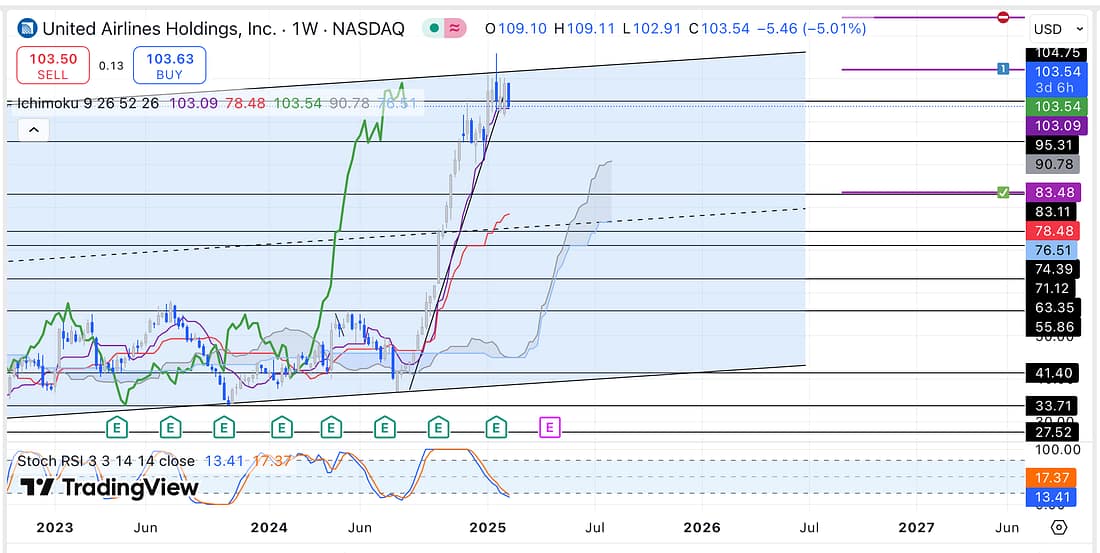

1. UAL – analysed:

2. UVXY – analysed.

3. USOIL – analysed.

4. UCO – analysed.

5. SAP – continue scaling into a SAP short position as the price continues to rise (increasing the likelihood of a decline):

6. INTC – analysed.

7. BIDU – analysed.

8. TIGR – analysed.

9. JETS – analysed.

10. DG – analysed.

11. COST – scale into an additional COST short positions as soon as possible:

12. GE – analysed.

13. HOOD – analysed.

14. PALL – analysed.

15. NATGAS – analysed.

16. RL – analysed.

17. X – analysed.

18. BIIB – analysed.

19. CMG – ranging.

20. AXP – analysed.

21. MRNA – analysed.

22. WOLF – analysed.

23. DJI – analysed.

24. RUT – analysed.

25. QQQ – analysed.

26. XAUUSD – analysed.

27. SPY – analysed.

28. FDX – analysed.

29. SOXX – still ranging.

30. MU – ranging.

31. SOUN – ranging.

32. FFIV – analysed.

33. BTC.D – analysed.

Learning Points

- UAL – the question for me to determine now is: should I take profits as the price action makes its way downward?

My current thoughts are that I should. This is because the price action has a high probability of experiencing a short rebound at the next approaching weekly / daily timeframe support level.

If it does, then I would have lost the opportunity to bank some profits, especially as there is no guarantee that the price action will definitely continue its decline.

So, this raises a further question: should I not be setting all of my profit target areas at all of the first approaching weekly / daily timeframe support or resistance areas?

The simple answers is yes (I think I should).

. - SAP – extremely important to remember that as the price rises higher in regard to parallel channels, counter intuitively, more capital must be traded to make up for the earlier entry losses in order for this trading style to make sense.

Next Action

- Scale into an additional SAP short position as soon as possible.

- Scale into an additional COST short position as soon as possible.

- Watch today’s “Trading the Close”.