Trading Watchlist:

1. XAUUSD

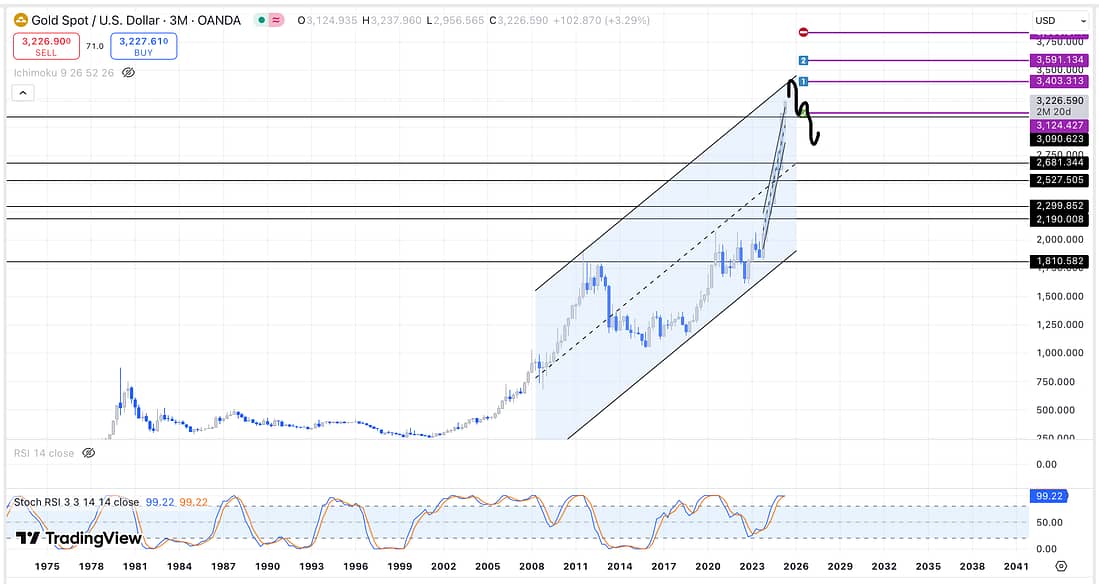

As can be seen above, the price action of Gold is approaching the upper trendline of a larger timeframe (3 months) parallel channel.

This increases the odds that institutional traders (the 90%) are going to take profits from their longs at this level, then commence short trades.

As a result, using limit orders, start scaling into GLD short trades as soon as possible:

2. GLD

3. GFI

In hindsight, as I previously suspected, GFI was the wrong asset to trade to take advantage of the gold price.

This is because it price action movement does not form the same pattern as gold’s price action precisely with it being more volatile and difficult to trade.

If I had known what I appreciate now, I would have taken profits quickly, instead of waiting for its price action to, potentially, further decline.

In contrast, GLD would have been a much better asset to trade in order to take full advantage of the price action movement of Gold.

For the reason that its price action movement almost perfectly mimics XAUUSD:

4. GDX

Start scaling into GDX short as soon as possible.

5. QQQ – analysed.

6. RUTS – analysed.

7. SPY – analysed.

8. UAL – analysed.

9. JETS – analysed.

10. BIDU – analysed.

11. HOOD – analysed.

12. NATGAS – analysed.

13. UNG – analysed.

14. UVXY – analysed.

15. DECK – analysed.

16. TTD – analysed.

17. SMCI – analysed.

18. DG – analysed.

Learning Point

- It appears that I have still got to iron out many weaknesses within my existing trading style and ability, especially when using parallel channels.

I have to accept, therefore, that in spite of my hard and consistent work (to date) I am still not ready to use larger quantities of risk capital for all my trades.

Instead, I have just got to continue doing the following:

(1) being extremely patient and fully immersed in the learning trading process;

(2) quickly improving my trading ability, day by day, from all of my trading mistakes; and

(3) write, write, and write.

. - Re-learned today that GLD cannot be shorted so this is why I traded GFI.

. - .Very important to keep up going through all of the different charts everyday.

Next Action

- Closely monitor XAUUSD every hour, today, in order to assess GFI short trade.

- Using limit orders, start scaling into a GLD short position as soon as possible.

- Start scaling into a GDX short position as soon as possible.

- Continue to ignore your daily profit and loss results everyday in order to ensure that you keep up carrying out trades that match the right setups or price action patterns.