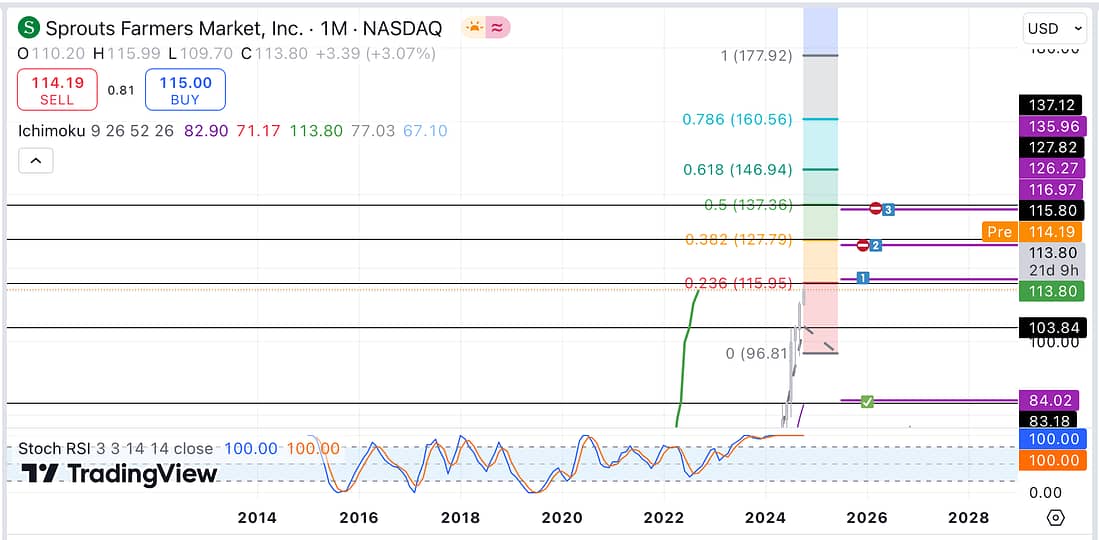

SFM

As can be seen above, SFM looks well overdue to decline on its monthly timeframe. That said, the market is the market; therefore, it can continue rising parabolically even though the odds of doing so will keep decreasing the higher and higher the price goes.

Thus, I have prepared a plan to make three additional 1/3 scaling in short entries on its monthly timeframe. This should increase the probability that this trade proves to be correct and becomes profitable.

Let’s see how this plays out!

Next Action

- Patiently monitor the price action of SFM everyday for the next two months (8 weeks) or so.

- Continue to focus on carrying out weekly timeframe trades.

WBA

Today, I decided to start scaling in into a long WBA position on its weekly timeframe, as I think there is a good possibility that it will start rising without notice at some point due to the fact that the price has been depressed for a couple of years.

As can be seen on the chart above, I have planned to make another 1/3 entry if WBA’s price action continues to decline to the next major support level below.

Let’s see how this plays out!

Next Action

- Continue to monitor the price action of WBA everyday on its weekly timeframe.

X

I decided, today, to short X on the basis that the weekly timeframe seems to indicate that the price action will decline to the next support level.

Let’s see how this one plays out also!

Next Action

- Continue monitoring the price action of X everyday in relation to its weekly timeframe.