Trading Watchlist:

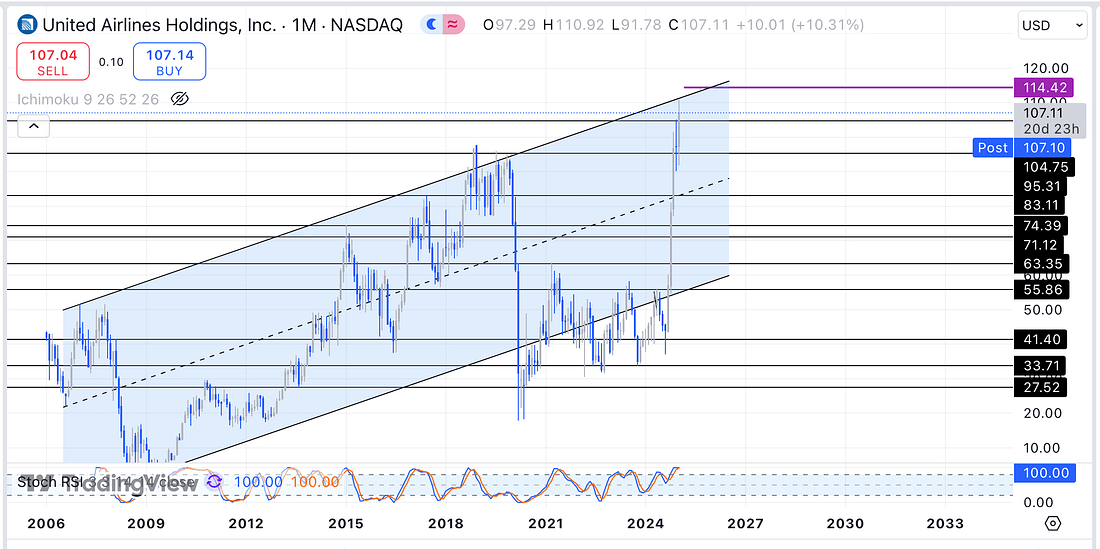

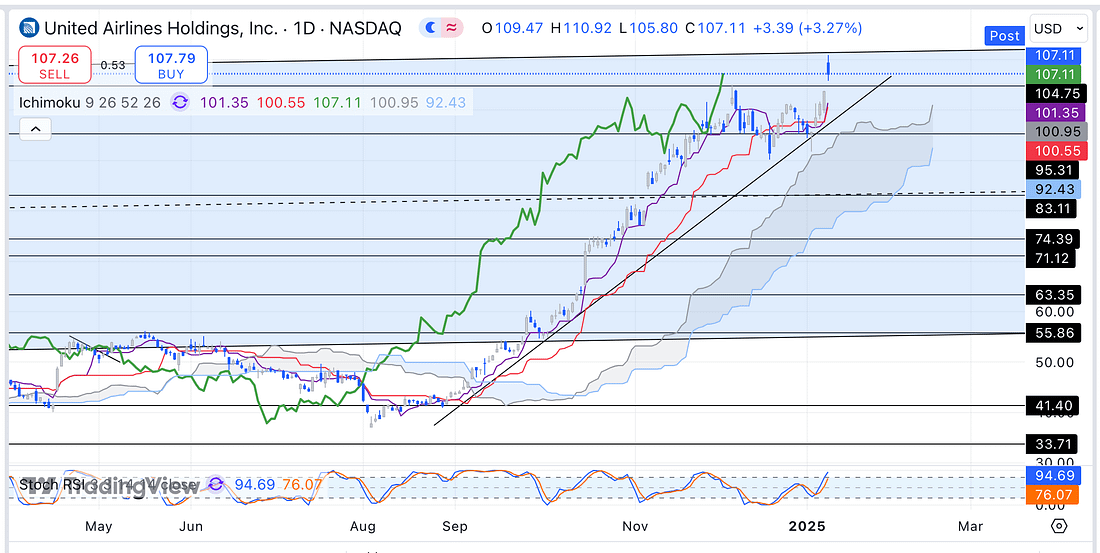

1. UAL – analysing UAL reveals that there is a high probability that the price action will be rejected at the longer term trendline on the monthly timeframe:

Especially as this area has at least two factors that make it a high-probability short opportunity:

(1) new all time high,

(2) price action at upper range on the Parallel Channel,

(3) the price action has rallied for 5 months without any significant pullbacks, and

(4) we would expect the price action to at least return to the middle of the Parallel Channel before any possible further rally.

That said, the price action is still bullish on the 4 hour timeframe. And because inexperienced traders are most likely to think that it is time to go short, this is make me think that I should actually go long til the next resistance level at the least. Hmm!

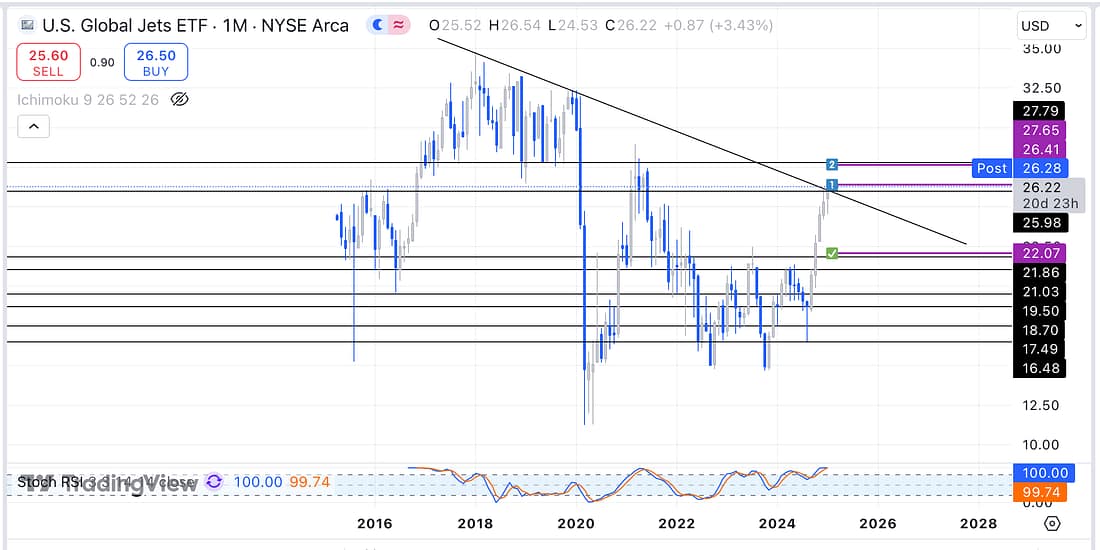

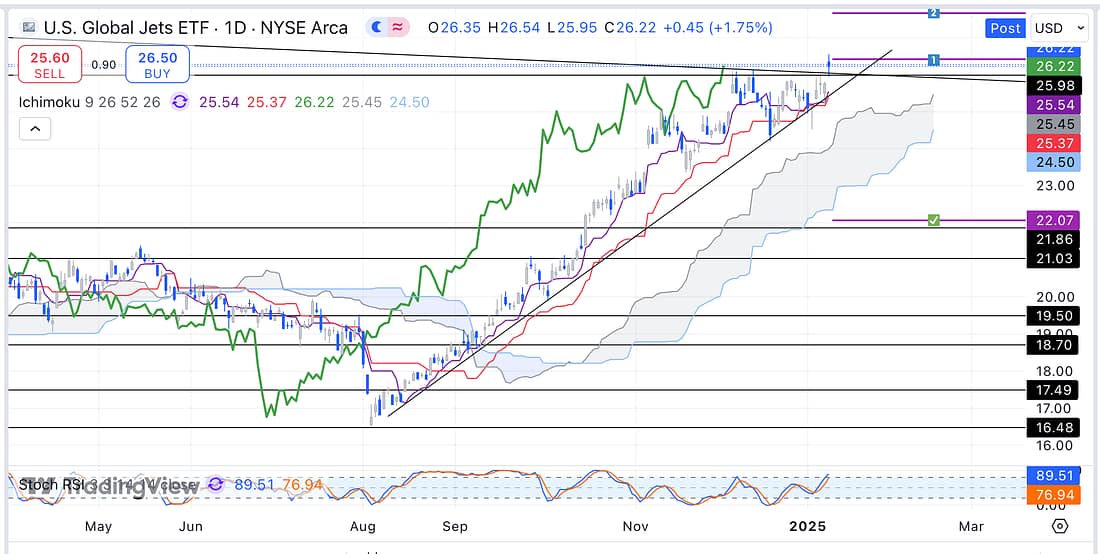

2. JETS – I have to re-assess my JETS short trades as the price action has not declined as expected:

As can be seen above, there still appears to be a high probability shorting opportunity presenting itself in relation to JETS on the monthly timeframe.

That said, there is no guarantee that the price action will not continue to rise. Therefore, still continue to not risk more than a small percentage of capital on the assumption that the trade will be entered in the wrong direction.

Also consider entering a long in relation to the 4 hour timeframe to hedge your active short positions:

3. SFM – analysed.

4. QQQ – analysed.

5. RUT – analysed.

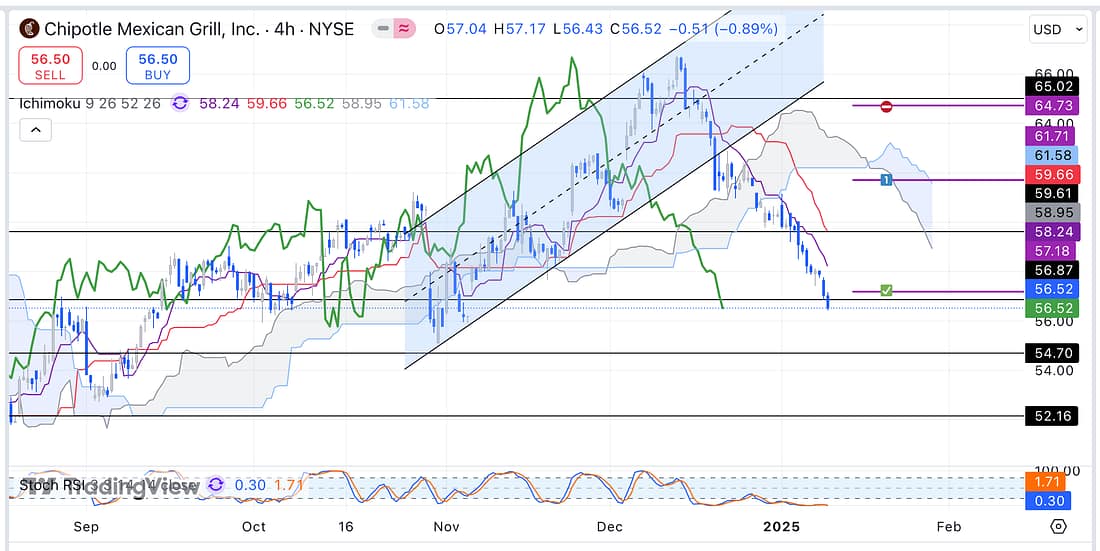

6. CMG – consider taking profits again as the price action has hit another major support level on the daily timeframe:

7. COST – analysed.

8. AXP – analysed.

9. WMT – analysed.

10. WBA – consider taking 50% profit out of WBA because back-testing reveals that the stock usually moves about 30% before pulling back substantially:

11. UVXY – consider taking 50% profit out of UVXY because the price action has almost reached the next key resistance level.

12. BIDU – analysed.

13. TIGR – analysed.

14. DG – consider exiting DG trade as there has not been any January price action pop as hoped for.

15. WOLF – WOLF has declined instead of experiencing a January price action pop:

In spite of this, continue to monitor WOLF using trendlines and the Ichimoku indicator for a good long entry:

16. SOXX – still ranging: looks like it is consolidating on the monthly timeframe in order to rally higher at some point.

17. US10Y – analysed:

18. TSM – analysed.

Learning Points

- If there is a parallel channel on the monthly timeframe then their is a higher probability that the price will eventually decline greatly in the long-term, instead of continuing to rally. That said, the price action on the 4 hour timeframe will give us the heads up in terms of when this decline is most likely to, actually, occur.

So, the question is, what would be the next best course of action?

Well, I think the following makes perfect sense:

(1) keep making short entries at the highest part of the parallel channel using limit orders,

(2) consider making long entries on the 4 hour timeframe, only, if the price action is at the lowest part of the parallel channel, and

(3) exit the long trade when the price action reaches the highest part of the parallel channel. - US10Y – the US10Y chart above reveals that when the price action reaches a monthly trendline it is still important to assess the price action on the 4 hour timeframe, and using a parallel channel to determine if probabilities favours a price action reversal. Otherwise, it is highly likely that I will still enter the wrong side of the trade (“first learn to trade, then the money will follow”).

Next Action

- Continue to monitor UAL closely everyday.

- Consider going long UAL next week (based on the 4 hour timeframe) as soon as the markets re-open.

- Consider going long JETS next week (based on the 4 hour timeframe) as soon as the markets re-open.

- Consider taking 50% profit from CMG when the markets re-open on Monday.

- Consider taking 50% profit from WBA when the markets re-open on Monday.

- Consider taking 50% profit out of UVXY when the market re-open on Monday.

- Consider exiting DG trade as soon as possible.

- Record the latest WOLF trading loss on the new trading spreadsheet.

- Continue to monitor WOLF everyday for a high probability long trade.