Trading Watchlist

1. BTC

Are we now witnessing Bitcoin act a safe haven assets like Gold I wonder as it has managed to hold its price even when the broader market was declining strongly?

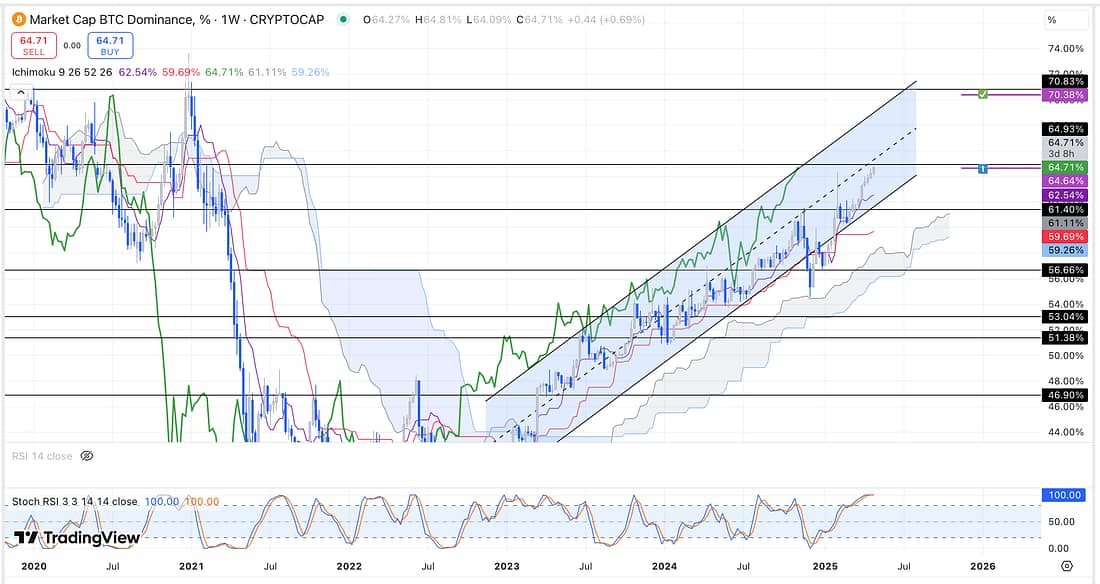

2. BTC.D

3. USOIL – analysed.

4. USO – analysed.

5. QQQ – analysed.

6. SPY – analysed.

7. RUT – analysed.

8. HOOD – analysed.

9. UAL – analysed.

10. JETS – analysed.

11. XAUUSD – analysed.

12. GFI – analysed.

13. US10Y – analysed.

14. TLT – analysed.

15. PLTR – analysed.

16. UVXY – analysed.

17. SAP – analysed.

18. BIDU – analysed.

19. NATGAS – analysed.

20. SFM – analysed.

21. DG – analysed.

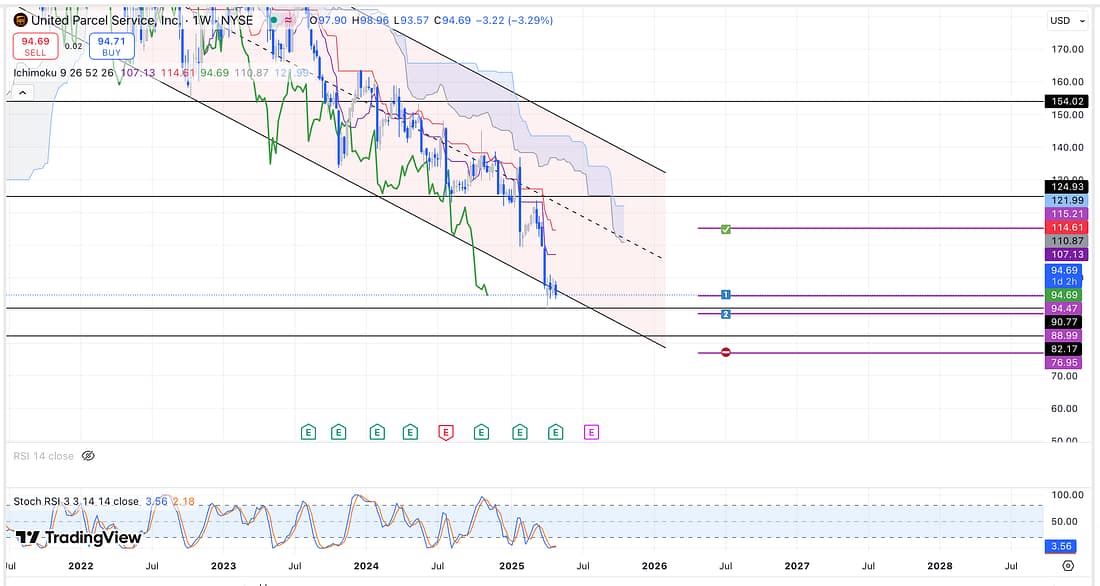

22. UPS

Start scaling into a UPS long trade as soon as possible.

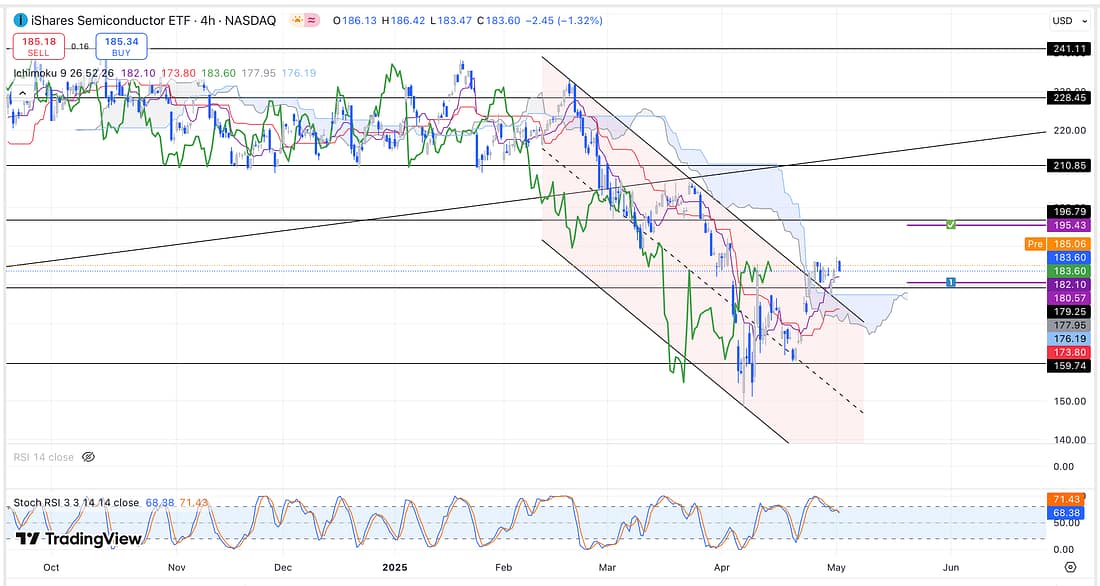

23. SOXX – (analysed) “where SOXX’s goes, the markets follow”:

Learning Points

It is extremely important for me to continue ignoring my profit and loss results, at this stage, in order to truly master anticipating the direction of the price action.

I am starting to, really, notice how much the profit and loss account interferes with my emotions, and so my trading decisions.

Instead of being fully focused on the trading process, and reading what the price action is telling me, a portion of my conscious mind is being allocated, non-productively, to the fear of losing too much in regard to my trading account.

In other words, I have got to become mentally tougher, which I can do easily by imagining my trading account falling then continuing to rise – as is typically always the case.

US Broader Market Decline

- FFIV

- UAL

- JETS

- COST

- AXP

- USO

US Broader Market Rise

- GFI

- UPS

- TLT

- BIDU

Next Action

- Start scaling into a UPS long trade as soon as possible.

- Favour long trading opportunity, over and above shorting trades, until my overall trading portfolio balances out.

- Watch today’s “Trading the Close“.

- Monitor the price action movement of SOXX in order to assess which way the markets are most likely to go.