1. SPY

As can be seen above, the SPY, which I am using as representative of the broader US stock market, has been in a yearly up trend for at least the last 5 years or so.

As a result, it looks long overdue for a market correction, whether that is using the Elliott Wave Theory as an indicator, or just visually acknowledging that the price action has been travelling vertically for several years now (what goes up, must come down or the mathematic principle of reversion to the mean).

In relation to crypto, this is important because Bitcoin is highly correlated with the broader US stock market. In other words, if the broader market goes down, Bitcoin (as a risk asset) is highly likely to follow suit, but with more volatility:

2. BTC

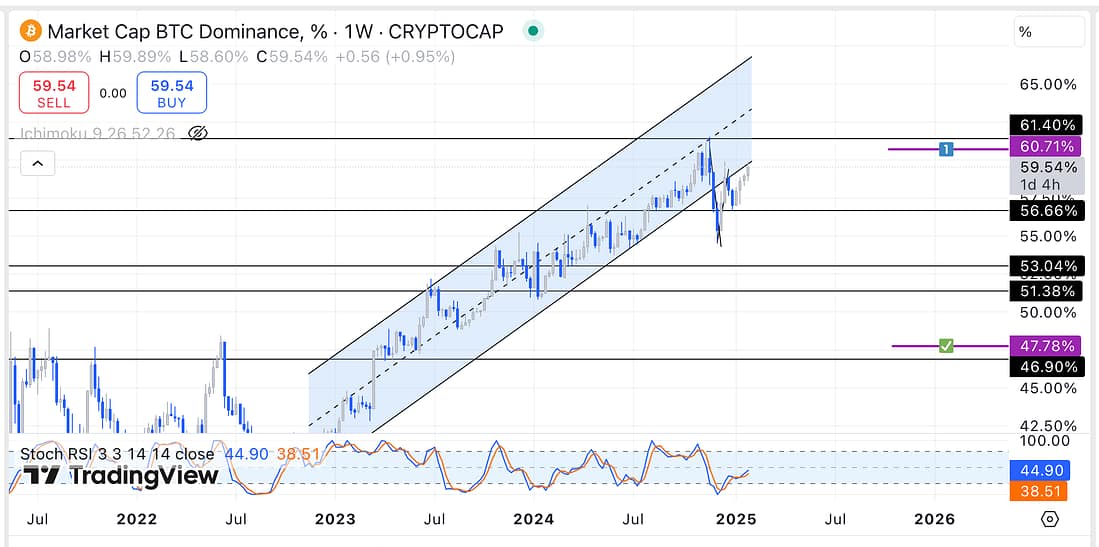

3. BTC.D

Back analysis revealed to me today that when BTC.D drops to around 40+%, then the Altcoins (i.e. Litcoin) will have reached their maximum price appreciation, making it time to exit all my holdings.

Learning Points

- Learning how to apply technical analysis everyday for the last two years or so has now made me very, very, comfortable, confident, and accurate at anticipating market movements.

- Social media is getting better and better and misleading individuals into believing any narratives that will harm a person’s actual self-interest.

- Consider converting some Bitcoin into substantial cash or into an Altcoin.

- Even though the yearly charts show that it is time for a major correction, the monthly and weekly chart still show that their is lots of room for the markets to continue rising. Therefore, this reveals the importance of always knowing, at all time, the long-term and short-term market outlook.

- Today, I re-appreciated the importance of analysing the markets everyday. This is because cognitive overload would stop a person from being able to really appreciate all important aspects of the markets, fluently and easily, without inducing a high level of stress. And with stress comes bad judgement. Thus, it is so important to breakdown and digest this knowledge over time by carrying out technical analysis everyday.

Next Action

- Continue to ignore the news entirely in the name of focusing primarily on listening to the charts using parallel channels and so forth.

- Keep a close eye on the Bitcoin Dominance chart, everyday, so that I will know roughly when to convert my Litcoin into cash.

- Consider swapping some Bitcoin into a great Altcoin.